The real cost of the COVID-19 impact is being felt by all businesses, but especially those being forced to cease operations. Live music venues have given the community priceless memories, and connected it with artists it knows and loves. Now those same venues in the greater Tampa Bay area are concerned about whether the community will make the mistake of waiting until it’s too late to stand up for the local music scene.

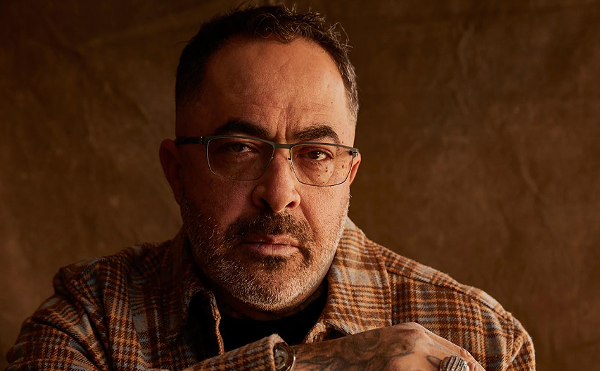

With no concerts on the horizon, and hundreds of canceled events, Tom DeGeorge, owner of Crowbar, fears that unless something drastic is done to address the loss of business activity nationally, many businesses will be boarded up, for good.

“A moratorium needs to be put on rent and mortgages. So we can freeze this thing for a proper period of time, while they figure out what the solution is.” DeGeorge, 46, tells Creative Loafing Tampa Bay.

“But if they don't, all that's gonna happen is people are gonna go out of business.”

DeGeorge says the impact on live music and events is being felt on all levels. In his eyes, a small demographic of businesses, like live music venues, were told to cease operations. Others were told to operate at 25%. Then there are big events like sports contests, huge music festivals, big concerts.

“Who knows when those things will come back?,” DeGeorge wonders.

“Those are all your non-essential businesses. So you would think that there would be money carved out for those businesses that were affected the greatest through no fault of their own,” he adds. “You think that those businesses would be protected, and they would be the first to get any money. You would think they would have already got the money—but they didn't.”

While there are many businesses applying for the Paycheck Protection Program, the ripple effect of the shutdown will reach far past the two months of worker pay covered by a PPP loan, according to DeGeorge.

His venue, like others the same size and larger, saw its entire spring concert season wiped out. DeGeorge knows he’s going to lose the majority of his big concerts in the fall and in the winter too.

“You're probably not going to operate at your normal numbers until much spring of 2021,” he says.

There are multiple options for businesses to get funding:

SBA’s federal Paycheck Protection Program (PPP) is one of them.

Round 1 of the forgivable loan funding was approved by the CARES Act. $349 billion was set aside to cover employee payroll through June.

Round 2 offered $320 billion, and loan processing began Monday, April 27.

Only forgivable if maintaining employment levels, which is tough to do at scale for businesses shut down 100%.

Businesses get equal to 2.5 times average monthly payroll up to $10 million.

This program intended to help small businesses, but has been exploited by big businesses, while small businesses are hung out to dry. "I never expected in a million years that the Los Angeles Lakers, which, I'm a big fan of the team, but I'm not a big fan of the fact that they took a $4.6 million loan," Treasury Secretary Steven Mnuchin recently said. The Los Angeles Lakers are valued at $4.4 billion.

SBA’s federal Economic Injury Disaster Loan (EIDL) gives $10,000 grants, with no need to repay.

Meant to give quick relief. Up to $2 million in loans, or the $10k grant. U.S. Small Business Administration filed suit against the SBA for taking too long to issue funds, which should have taken 3 days. But many haven’t issued funds for weeks to some applicants.

The Florida DEO’s statewide “Florida Small Business Emergency Bridge Loan Program”, which we’ll get into.

Less than 3% of businesses applying for the $50 million available in the Florida Small Business Emergency Bridge Loan program received any money. The Florida Department of Economic Opportunity approved 1,000 loans, out of 38,000 applications. This program was designed to help small businesses make up the revenue gap. There is a $50,000 cap for each loan for the program, which DeGeorge says will barely make a dent in his losses.

“Not only do I have, you know, probably $400,000 in lost gross revenue, but if I'm only getting $50,000 it's not gonna carry me through the whole year. It's just wrong. There's no way to do it because the shows aren't going to be there,” DeGeorge explains.

DeGeorge—who had a preliminary phone call, discussing the matter with Tampa Mayor Jane Castor, on May 1—thinks money should’ve gone to the smaller businesses.

“But they didn't give anything to us. And that's why I've taken out $100,000 in personal loans, because I know I'm going to need more money,” he adds. “I know that's what I'm going to need to get through this.”

State Senator Janet Cruz had requested an additional $50 million and emphasized the $50,000 cap, especially with some businesses exploiting that loophole by taking multiple loans.

As DeGeorge is forced to lose $400,000 in revenue while getting no approved Economic Bridge Loans, companies like 4Rivers were able to obtain four separate loans each for one of their four BBQ restaurant franchise locations. The total amount of those four loans was $400,000. Florida Politics reported that at least 13 other businesses also got four loans each, totaling more than $100,000 per loan. More than 60 business owners received multiple loans. Except many of them are still offering takeout, and as of May 4th, several others began offering outside dining at 25% capacity; unlike other businesses forced to shut down completely.

While DeGeorge is still waiting on the PPP funding that he applied for in the first round, he says that even the EIDL won’t cover costs for staying open to maintain PPP eligibility.

“If you're a small business that's been forced shut for two months, then they'll give you a forgivable loan of $50,000 and you're gonna have to pay all the bills you weren’t able to pay while you were closed. Because utilities aren't stopping. Landlords aren't stopping asking us for their money. You've been paying your staff,” DeGeorge explained. “So now after you paid everything you're left with about $15,000, and you're still not even open yet.”

His biggest fear is not being able to keep the brick and mortar aspect of the business afloat through the shutdown. If DeGeorge doesn’t pay his landlord, then his landlord is suffering and says, “Listen, you know, it's been three months, if I don’t get the rent, what am I going to do?” What if a big developer comes to the landlord and says, “Listen, I'll buy your building.”

“And if I'm defaulted on my rent, I'm going to be out,” DeGeorge says, reiterating that freezing bills and mortgages is the only way to really stop the bleeding at the source.

He wants the federal government to step in and make sure that those bills then turn into a grant, and those expenses are covered for the small businesses and regular residents struggling to pay rent or mortgages.

“Nobody should be put in a situation where they lose their home, or their business or their apartment, because of this, it's just not right,” he says. “If you were one of the businesses that was deemed non-essential, and everything that's happening to you in life right now, is because of this virus, you should be being protected first.”

Federal help didn’t go where it should’ve

There would have been plenty of money to do that, in DeGeorge’s view, if it didn’t go to other people that shouldn't be getting it.

Major restaurant chains with substantial cash flow like Ruth’s Chris, Shake Shack and others took millions of dollars in loans, then returned them after public outcry. Publicly funded companies have been asked by the Treasury to do the same, but many companies like cruise ship line Lindblad won’t do it. It took out a $6.6 million PPP loan, despite having $137 million cash on hand as of March 31, and a market value of $276 million. So while its cruise ship company may need to pay more than 400 employees, small business fixtures that define local culture are getting passed over.

DeGeorge thinks the funds should have gone to the service industry first, since it was most affected.

“After the money was divvied up through the service industry, then I could see opening up what was left over to other businesses, but I think you have to allow the businesses that were shut down first to have access to that money,” he explains. “Unfortunately, that didn't happen.”

Public shaming of these companies was the only thing that got them to change their mind.

“Across the board, people need to do the right thing. Whether it's local government, bigger federal government, chain restaurants, franchise restaurants, that money needs to go to the people who truly need it,” he adds.

DeGeorge recognizes, however, that within the live music and events scene, large stadium events and festivals make up part of the bigger picture, but argues that you can’t get to that level without the small businesses and mom-and-pops that make up the fabric of the communities they serve.

“I was on a conference call earlier about festivals and I was saying, you know, it's the smaller businesses that groom the artists or areas to have festivals in the first place. I think the whole trickle down way that the money was used—it didn't trickle down,” he explains. “A lot just went to the top. You know, it's just totally unacceptable.”

Business 101

Unlike pop-up restaurants, and other operations that can start selling with a quick turnaround, DeGeorge says most business models don’t plan for profitability at the flip of a switch.

“What you're telling every single small business bar and restaurant and nightclub concert venue in the country, is ‘You're doing your grand opening again,’” DeGeorge explains.

For him and others, the eventual reopen is going to be like the first day he opened, except now he has a bigger pile of debt he’s accruing while his business sits idle after not getting assistance.

Business 101 says you must have a business plan. But what if your business model doesn’t include an uncertain concert calendar for the next three months?

DeGeorge said the current climate doesn’t allow for businesses to have confidence in executing plans that are a key component of success.

“You know how much money you need to get yourself ready. You pick the date you're going to open. You fill your calendar, or you get your menu together. You execute your plan, and you open,” he says. “We are not playing by those rules right now.”

With something as extraordinary as the coronavirus shutdown, DeGeorge says the new rules are outside of his control. But what is in someone’s control is how the money is divvied up between small businesses.

“Somehow this thing's really been botched horribly. And if it continues this way, many small, independently owned mom and pops, single store businesses will either not reopen at all,” DeGeorge says, pointing out that “small” has been defined as less than 500 employees under the PPP. “Or they will reopen, and they will be forced to close six months down the line because they were never given a fair shot at it in the first place.”

His worries about anxious landlords, lead to bad dreams about businesses being boarded up, sold and torn down.

“It shouldn't happen. It's a crime,” DeGeorge says.

Make noise

He thinks staving off the worst of the damage will require political action from the public that enjoys venues like Crowbar and New World Brewery or small businesses like New York, New York Pizza, La France or the small shops in St. Petersburg.

“They should let their local reps know that they are not going to sit back and watch every small business get shut down by no fault of their own. And if they see that happen and they see funds misappropriated. They're going to vote people out,” DeGeorge says.

Politicians, like everyone else, are not keen to lose their jobs right now, and DeGeorge mentions that now is an ideal time to remind them that they could join the ranks of millions of unemployed workers if they fail to meet the expectations of their employer: voters.

“These people base their decisions on what they think will get them re-elected. So if enough people speak up and let them know they are furious. And that what has happened so far has been a terrible injustice. That should have never happened, but it has to stop now, or else, it's going to be a big deal,” DeGeorge says. “Heads are going to roll, and people are not going to get voted back in.”

And he says voting is not even half the battle.

“I assure you that the right thing will not happen from there until people start speaking up, lobbying... So until people get in those people's ears, real change will not happen.”

Enter NIVA

Tom is part of the National Independent Venue Association, or NIVA. It represents 800 influential live music venues nationally. NIVA estimates that $1 spent on a ticket at a small venue leads to $12 of economic activity generated within the local communities. This generates $10 billion annually for local economies. Live Nation, AEG, Broadway and venues, promoters, and producers estimate 25,000 concert industry jobs have been lost. Here’s an excerpt of the letter NIVA sent to congress:

“While we have no income, we do have essential employees, employee benefits, debts with personal guarantees, rents or mortgages, utilities, insurance, local, state and federal taxes, and the massive burden of ticket refunds for more than 100,000 canceled shows due to COVID-19. Many of our members, such as Pabst Theater in Milwaukee (est. 1895), the UC Theatre Berkeley (est. 1916), the Wilma in Missoula (est. 1918), Cain’s Ballroom in Tulsa (est. 1924), Newport Festivals in Rhode Island (est. 1954), the Troubadour in Los Angeles (est. 1957), Preservation Jazz Hall in New Orleans (est. 1961), First Avenue in Minneapolis (est. 1970), Exit/In in Nashville (est. 1971), Antone’s in Austin (est. 1975), the 40 Watt in Athens, GA (est. 1979), and Metro Chicago (est. 1979) are historic, iconic institutions that have withstood normal business cycles and economic hardships. Our passionate and fiercely independent operators are not ones to ask for handouts. But because of our unprecedented, tenuous position, for the first time in history, there is legitimate fear for our collective existence.”

NIVA is also calling for increased PPP funding, a delay in potential paybacks until they can operate at full capacity, debt deferral, and tax relief for shuttered businesses, not merely those at reduced capacity.

Another letter written by Live Nation, Broadway, and major producers indicates the cultural devastation of not stepping in could be irreversible.

“The cultural impact of our venues on our local communities is priceless. We are the steadfast incubators and launch pads for the most popular talent in the world. Our stages give artists like Adele, U2, Keith Urban, Prince, Lizzo, the Eagles, Wu-Tang Clan and Foo Fighters their start. The world could be without the next Lady Gaga, Kenny Chesney, Chance the Rapper or Bruce Springsteen if we cease to exist. Independent venues and promoters are crucial components of the music industry’s ecosystem, without whom there will be dire ramifications for artists as fan spending plummets.“

Save the strip

Also operating in Ybor City is The Ritz Ybor, formerly The Masquerade, which DeGeorge managed prior to purchasing the Crowbar. Like Crowbar, The Ritz hosts everything from rap and rock, to indie and EDM. It serves as a popular nightclub, as well as a destination for fashion shows and festivals like WMNF’s Tropical Heatwave, which in 2016 included The Crowbar and multiple stages inside The Ritz multi-venue live music experience. Current Ritz manager Pawl Cifelli told Creative Loafing Tampa Bay that while live music venues have been deemed nonessential, many essential workers have relied on the experience for fulfillment in the past.

“I can understand the essential feeling of not just music but the interaction with people like you know, you have people that spend their weeks in a cubicle or driving a truck or whatever it may be where they're not able to interact with people,” he says. “So I can even understand the music being essential. Human interaction is essential to people's mental health and their general wellbeing.”

It’s that essential feeling that Cifelli says may have led the Mayor of Las Vegas to consider reopening early, despite that idea getting nixed by the governor of Nevada.

“It makes it very transparent about how reliant that whole city is upon those businesses in travel, and the casinos and gambling. It seems it's her move, in my opinion, out of desperation because they see economics-wise, big picture what's happening to their city. Looks like to me, she's desperate to open things back up to get revenue generated to save those businesses. That city is just wholly reliable upon travel and tourism.”

Like “the strip” in Vegas, Ybor City is the heart of much of Tampa’s live music scene, although other neighborhoods like Seminole Heights have become hip hotbeds of nightlife and events.

Paul Medrano laid a pretty good foundation in Seminole Heights with Red Star Rock Bar, so he opened a second location in Ybor City, a couple hundred feet from Crowbar in the old Green Iguana and Kelly’s space. The venue’s been well attended, and up until the shutdown, his revenue was keeping up with overhead. His Ybor landlord, attorney Frank De La Grana, is giving him a break on rent for a couple months, so his attention turned to other costs. He’s hoping some vendors will offer an inventory buyback. He’s selling perishables at cost so that the product doesn’t die on the shelf or in cold storage.

“And then when you start back up, I mean, do you have to buy all that inventory back? If you don't have that money coming in from the government, you're going into your pocket, or borrowing money or liquidating assets,” Medrano says. “I mean it’s helping, it covers the electric bill. But places where there's a lot of rent like in our Ybor locations, not even close.”

Run aground

Meanwhile, other longtime favorite Tampa concert venues like Skipper’s Smokehouse have also been forced to close. The venue has been the choice location for many WMNF 88.5-FM Community Radio shows. And even though Skipper’s has its mortgage paid off and a popular seafood restaurant paired with the live music and bar offerings, the venue’s still been shut down since March 23, according to owner Tom White.

“We’re world renowned for our food and as well as the music,” White told Creative Loafing Tampa Bay. Problem is the music and the food complement each other. “People would come for the music also, you know, people would come for just to eat, and they go, 'You got music here? Oh, wow.' They maybe go out, go to a show or they come to the next show, you know? So, it's a very symbiotic relationship with our food and an alcohol.”

And PPP lending with the big banks has been on a first come first served basis. Law firm Rifkin Weiner Livingston sued Bank of America for class action and filed a motion for a temporary restraining order, but a federal judge ruled that small businesses do not have a right to sue the big banks over lending rules. The main concern is that Bank of America and others are being selective about only lending to those clients with whom they already have an established relationship, leaving others like White to wait for answers.

White says emails to Skipper’s from Bank of America claim the band is going to submit to the SBA. He knows some people got money through smaller and community banks.

“I don't know why they didn't do it last time or what happened last time,” White says. “Well, we all know what happened last time Ruth’s Chris, Shake Shack, and Harvard, all these other freakin people that shouldn't have been getting this money… got all of our money, you know, for the small businesses, the small independent people.

While he waits for the loan to go through, White is turning to crowdfunding to get by.

“We have, you know, 30 to 40 people at work up there, so we’re trying to get some food on their plates. You know, we have a GoFundMe thing going on right now,” White explains. “Hopefully that's raising a little bit of money for the bartenders.”

But if White gets his PPP loan, he wonders what will happen after June.

“So you think Trump or DeSantis are going to flip the switch and say, ‘Okay, you get to go 100% full bore Let's, ramp it up.’ But you know, who's going out? Nobody's going out. I mean half the people are not going to go out,” White says, adding that he thinks Skipper’s could be limited to gatherings of 50 people or less. “You know what that's gonna do to us? It doesn't pay to open the doors.”

And even though Skipper’s ramped up cleaning stations and offered takeout for a while, White said it wasn’t enough to break even.

“All music has been canceled in April, of course, and I had a bunch of really cool shows set up in May. And most of those have canceled at this point. I mean, I haven't canceled some of them towards the latter part of May. And I've got several WMNF events.”

Distress signals

But out of respect for the seriousness of the COVID-19 shutdown, WMNF has postponed all shows and events until further notice. Program Director Randy Wind told CL that the listener-sponsored station has been more than merely an alternative to mainstream media, it’s been a beacon of hope and a companion for people as they continue social distancing in isolation. It’s part of the community. He says listeners have been supportive.

“They’re valuing the fact that we've been able to stay on the air with live programming and a lot of very special programming during this time,” Wind says. “We had that one-day fundraiser, Sarasota Giving on Wednesday which raised like four times more than we did the last time.”

Live music has been a big part of WMNF, in addition to its ‘round the clock radio programs. But Wind says it’s prepared for the possibility that we won’t see live music really rebound until next year. The nonprofit station has been reaching into emergency reserves while asking listeners to donate if they can.

In addition to the radio component of musical broadcasting, musicians have taken to online live streaming. Anthill Cinema has been posting quality “quarantunes” recorded videos. Other artists like, Shevonne, Danielle Mohr, Stephanie Perez, Jam Jones, Apple Butter Express, Dennis Stadleman, and more have taken to the new format often including payment information on screen to receive donations. Local music schools like Tampa Fine Arts Academy have begun to offer virtual lessons. Even the likes of Chris Martin of Coldplay, Foo Fighters, The Florida Symphony Orchestra, and other well-known international artists have embraced the new normal in music. On a larger scale, groups like The Happeneers and Socially Distant Fest are consolidating musical acts for livestream festivals to keep the music alive.

No club, no concert

With brick-and-mortar businesses looking increasingly desperate for solutions, some music businesses have turned to online sales. Tony Rifugiato owns Daddy Kool records, an independent music shop that sells vinyl and other merchandise out of its St. Pete store, but also online. He seemed pleasantly surprised that much of the shops sales are increasingly going digital.

“Since we've opened up our new website, all of a sudden we have an MP3 download section that's doing great,” Rifugiato says. “I know it’s only 99 cents a download, but all of a sudden they were getting as many orders if not more now from MP3 downloads than we are selling albums at the moment.”

And Rifugiato said that live streaming is at the very least a boon to collective creativity.

“What happens in crisis like this is that you have your backs up against the wall, and that's when you become the most creative. So if you really want to do something, you can do something,” he adds.

Many artists are feeling the pinch of all the cancelled shows, and many of them don’t qualify for support for foundations like Musicares, because they aren’t considered “full time” Of course for most musicians much of the allure of a lifestyle of playing music is having a flexible schedule. But even still, gigs are hardly, if ever, guaranteed, and getting a high enough volume of weekly or monthly gigs to be considered “full time” is neither normal nor easy.

That volatility goes with the territory in the live music industry as many gigs are booked on a handshake. But even with contracted events, the uncertainty of when large gatherings will be legally permissible has created even less confidence for show promoters. In addition to Daddy Kool, Rifugiato operates No Clubs, a live music booking agency. The shutdown has put that business into a bit of a holding pattern.

“We've got dates rescheduled in July onwards, and now they're coming up,” he explains. “And so we say, ‘Just in case you're not allowed to play, can you start looking at dates and 2021?'”

Rifugiato says 2020 was one of the best years for booking in the last decade, and that No Clubs had more shows lined up in the next six months than all of last year.

“That's how the market has changed. All of a sudden, this came along and bam, it's just gone,” he adds.

Unlike many local artists who have completely lost future revenue, some of the big acts have already been paid in advance for their shows, leaving live music booking companies holding the bag.

“A lot of that money's already been put out to artists and expenses,” Rifugiato explains. “So you know you have to kind of go backwards and rework that out. And the artist is going to do everything he can to not cancel a show you know.”

However, it doesn’t seem like many of them have a choice in the matter under the current shut down. And like Tom White of Skipper’s, Rifugiato is not confident business as usual will be a certainty.

“I don't think anybody's going to say 'Oh, go ahead and have a concert in a 20,000-seat arena' just like that without any safeguards. So that's number one. Are they gonna fulfill those numbers?,” Rifugiato wonders. “And secondly, there's always going to be the people that say, ‘Hey, I'm not going to go out. I'm dog sick, it's still not safe to go out.’ So you know, I'm not expecting 100% of the people that start coming flocking back out of the shadows.”

Crowbar’s DeGeorge is positive that venues choosing to open too soon will be shamed for putting lives at risk. And so if people want to keep the foundation of the live music community intact, the public must demand action now.

“Our local leaders need to step up, because they're not coming up with the right solutions and they're not asking for the right solutions. They're not asking for places to be protected in the manner they should,” DeGeorge explains.

“Restaurants will start the process. Bars and concert venues will wait,” DeGeorge recently wrote on social media. “Please be responsible when going out next week folks. Your favorite bars and music venues depend on it.”

Support local journalism in these crazy days. Our small but mighty team is working tirelessly to bring you up to the minute news on how Coronavirus is affecting Tampa and surrounding areas. Please consider making a one time or monthly donation to help support our staff. Every little bit helps.

Follow @cl_music on Twitter to get the most up-to-date music news, concert announcements and local tunes. Subscribe to our newsletter, and listen to us on WMNF 88.5-FM’s “Radio Reverb” program every Saturday from 4 p.m.-6 p.m.