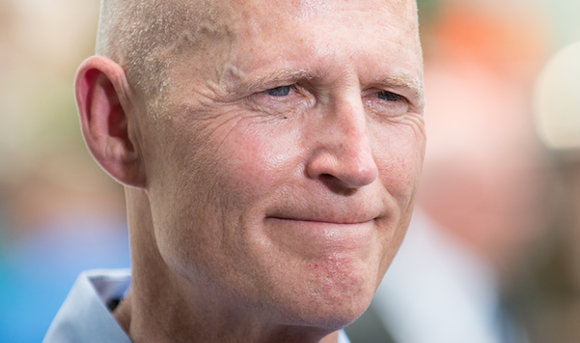

Gov. Rick Scott has investment ties to the contractor that botched an upgrade to Florida's SunPass toll system last summer and caused an enormous backlog of 170 million transactions that took months to fix.

The Tampa Bay Times traced the Republican governor's financial link to the vendor Conduent through financial disclosure statements filed in July. Scott is running against Democratic incumbent U.S. Sen. Bill Nelson.

The disclosures show Scott and his wife Ann have invested at least $5 million in a hedge fund managed by Highline Capital Management. Highline holds $127 million in stock in Conduent, making it the company's sixth-largest shareholder, the Times reports.

The Florida Department of Transportation awarded the $287 million contract (which has since increased to $343 million) to Conduent State and Local Solutions in 2015. The newspaper notes Scott attended a Dallas campaign fundraiser in May where one of the fundraiser's hosts was investor Darwin Deason, a "major shareholder in Conduent."

For weeks, Scott refused to elaborate on Conduent's botched SunPass upgrade, until finally in August, FDOT announced an investigation into the vendor's "failures and mismanagement" of the transition. The state also fined the contractor nearly $800,000 in damages. A month before, the state had even suspended payments to Conduent because the system wasn't operational.

"This is not what they expect," FDOT Secretary Mike Dew said last September in his apology to Florida motorists. Dew was appointed by Scott. "This is not what they deserve. This is not what SunPass is supposed to do. And they had to endure a lot of complications over the course of the summer."

"Scott's financial link to the SunPass vendor is at least the seventh reported example of the wealthy governor's personal investments in corporations that do business with or are regulated by the state he governs," the Times reports.

The New York Times reported earlier this week that Scott's blind trust — a $73.8 million investment account the governor created that is run by an independent third party to shield Scott from potential conflicts — is "blind in name only." According to the Times:

"There have been numerous ways for him to have knowledge about his holdings: Among other things, he transferred many assets to his wife and neither 'blinded' nor disclosed them. And their investments have included corporations, partnerships and funds that stood to benefit from his administration’s actions.

Only in late July, when compelled by ethics rules for Senate candidates, did Mr. Scott disclose his wife’s holdings. That report revealed that his wife, Ann Scott, an interior decorator by trade, controlled accounts that might exceed the value of her husband’s. Their equity investments largely mirrored each other, meaning that Mr. Scott could, if he wanted, track his own holdings by following his wife’s.

The filing revealed that the Scotts together were worth between $254.3 million and $510 million."

In a statement to the New York Times, Scott said, "I have never made a single decision as governor with any thought or consideration of my personal finances. I will not apologize for having success in business."

This article originally appeared in Orlando Weekly.