I never met a politician who didn't get mileage from promising to cut taxes. And the occasional candidate who answers the question truthfully about where we're going to find more money for roads, schools, police and parks always gets creamed at the polling place (see: Mondale, Walter).

But let's be brutally honest about Florida's tax situation: We've got it easy.

The tax burden of the average Floridian ranks just 39th in the nation, cheaper than such stellar places to live as West Virginia, Kentucky, Arkansas and Iowa. Floridians pay just a bit under 10 percent of their incomes for state and local taxes, according to an analysis by the Tax Foundation, a nonpartisan group famous for calculating the Tax Freedom Day, the date that represents how long it takes the average person to pay off their taxes annually.

The local and state tax burden in Florida? About $3,500 for every man, woman and child.

So why is it that Floridians are up in arms about property taxes, marching on city halls with wooden three-tined pitchforks like a scene from Young Frankenstein?

Well, 'cause we're, as a state, cheap. And worse: We're very, very used to being cheap. Combine that with skyrocketing property values that have turned $90,000 homes into $450,000 tax bombs and you have the makings of a real tax revolt.

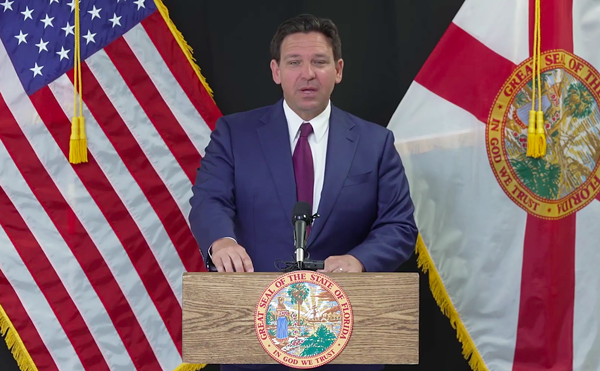

So Gov. Charlie Crist, ever the populist, is pushing reforms that would lower tax bills by strangling what he calls the runaway spending of local governments. He proposes:

• Doubling the homestead exemption, taking an extra $25,000 of your home's value off the tax rolls.

• Allowing homeowners to take their Save Our Homes tax cap to a new home. Currently, Save Our Homes prohibits property appraisers from increasing the value of your property by more than 3 percent a year, keeping longtime residents' taxes artificially low and shifting the burden onto newcomers and those who want to trade up to a bigger house or empty-nesters trading down for smaller digs.

• Giving small businesses the same type of tax cap that limits the growth of their property values and hence their taxes.

His changes would save hundreds of millions of tax dollars statewide. And since those lost taxes would punch multimillion-dollar holes in county and city budgets, it is no surprise that the Crist reform package is being opposed by groups such as the Florida Association of Counties, who want more gradual and measured approaches to tax reform.

That doesn't mean, however, that local politicians haven't seen the handwriting on the wall, or more literally, the lines of angry citizens at last year's budget hearings.

"I would support us doing even more in rolling back taxes," said Pinellas County Commissioner Calvin Harris. "We can't continue to do what we've been doing as governments. We buy new vehicles, but our constituents can't afford to buy new vehicles. We give a 5 percent raise when the private sector is giving 2 percent raises."

In Hillsborough County, the acceptance of the inevitable is even stronger. Commissioner Jim Norman proposed capping the growth of the county budget. It passed 6-0.

Some parts of the Crist reform package defy attempts to put a price tag on them. The easiest to quantify is the doubling of the homestead exemption. In Pinellas, it would cost county government $43 million. In Hillsborough, that figure would be about $65 million.

One alternative to property tax reform is intriguing. "There's something the state could do that other states have done — everything is taxable on the Internet," said Eric Johnson, the budget director at Hillsborough County. The problem is that courts have said Florida cannot force states outside of Florida to collect its sales tax, leaving the state to try to collect it from the buyers instead of the sellers.

Johnson said other states are figuring out relatively painless (if voluntary) ways to collect the sales taxes from online purchases, most of which are made by businesses, not individual consumers. Florida, however, has not had the interest or political will to join in.

A University of Tennessee study projected that Florida will lose out on $3.2 billion in online sales taxes this year. Even a fraction of that would be enough to make all this property tax agita go away.